Want to jump straight to the answer? The best online payroll services for most businesses are definitely QuickBooks and Gusto.

Historically, payroll has been one of the most complex elements of running a business. Business owners need to make sure that everyone is paid with 100% accuracy, including calculations related to taxes, benefits, and more.

How hard can it be? Well, about one-third of small businesses are fined by the IRS each year because of payroll mistakes. With more businesses working with remote staff, freelancers, and independent contractors, payroll is no small feat.

But modern payroll solutions are changing to accommodate this. We’ll show you the best solutions up to the task.

The 7 Best Online Payroll Services

Depending on the size of your business, there are only seven online payroll services that I would recommend:

- QuickBooks Payroll — The best for a worry-free tax season

- Gusto — The best if you have a ping-pong table in the break room

- Paychex — The best for complex payroll cycles

- ADP Payroll — The best for businesses making a hiring push

- Deluxe Payroll — The best price for included HR features

- OnPay — The best for remote workforces

- Square Payroll — The best for retailers and restaurants

Read on about the features, pricing, pros, and cons of each service to find the best one for your business.

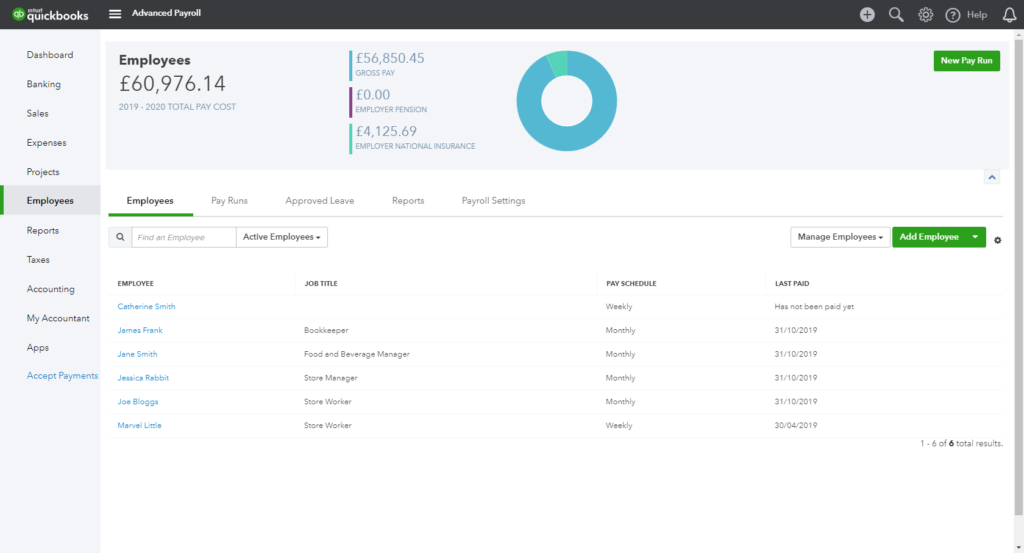

#1 – QuickBooks Payroll — Best for a Worry-Free Tax Season

- Starting at $45 per month

- $25,000 tax penalty protection

- Full-service payroll

- Great for managing invoices

QuickBooks is best known for its small business accounting solutions. But the company also has an outstanding online payroll service.

If you’re already using their accounting solution, it’s a no-brainer you should use QuickBooks Payroll too. You can easily add QuickBooks Payroll to your existing QuickBooks accounting plan.

The result will be a seamless all-in-one solution for your accounting, payroll, and HR needs.

All local, state, and federal taxes will be calculated and paid, automatically, each pay cycle. You can also run Auto Payroll after the initial set up to minimize the time spent running payroll each week.

The reason I love Quickbooks is because of their tax penalty protection. In fact, they’ll pay up to $25,000 if there’s an error in your payroll and you get hit with a tax penalty.

You can’t beat that level of peace of mind during tax season.

As you would probably expect, the biggest benefit of using QuickBooks Payroll is its integration with QuickBooks accounting software.

Your bookkeeping records and reports will be updated in real-time with each pay cycle. This also makes it easier for you to share payroll information with your accountant.

Here’s a brief overview of the plans and pricing for QuickBooks Payroll:

Core — $45 per month

- $4 per month per employee

- Full-service payroll

- Auto payroll available

- Health benefits

- Expert support

- Next-day direct deposit

Premium — $75 per month

- $8 per month per employee

- All Core features

- Same-day direct deposit

- User permissions

- HR support center

- Premium time tracking with mobile app

Elite — $125 per month

- $10 per month per employee

- All Premium features

- Elite onboarding

- Elite time tracking with project planning and geofencing

- Tax penalty guarantee

- Personal HR advisor

Overall, QuickBooks Payroll is as solid as it gets. They offer exceptional customer support for such a large company. If you have any problems, questions, or need assistance, it’s easy to get things resolved.

If you are already using other QuickBooks tools for accounting or time tracking, I highly recommend using them for payroll as well. Someone clocks out and QuickBooks starts doing the math, calculating taxes, updating the books, and now it’s done.

Even as a standalone payroll solution, QuickBooks is very impressive. You’ll always be up to date, and come tax time, you know where everything is. Simplify your process today and thank your future self. Click here to visit QuickBooks and learn more.

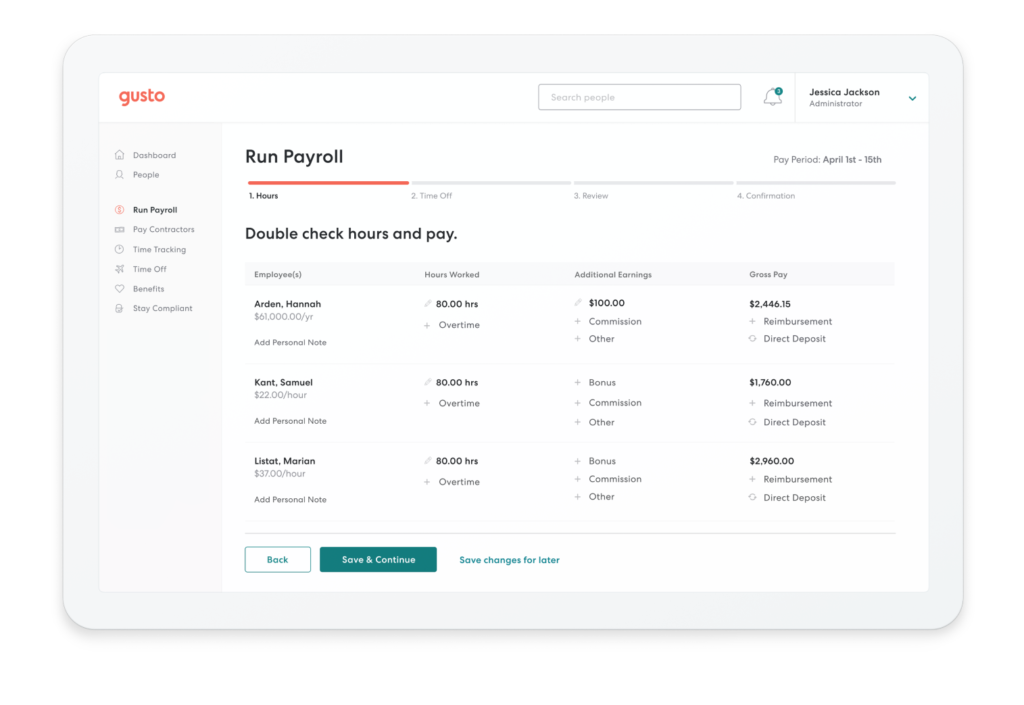

#2 – Gusto — Best If You Have a Ping-Pong Table in the Break Room

- Starting at $39.99 per month

- Best for startups and new businesses

- Unlimited payroll cycles

- Easy access to pay stubs & benefits

Gusto offers one of the best online payroll services out there. They serve more than 100,000 businesses across the country.

The reason why so many companies are choosing Gusto for payroll is because of the platform’s simplicity. It’s easy for anyone to set up, manage, and pay workers.

That’s what makes it perfect for startups and new business ventures. They’re perfectly scaled for small-but-growing operations, and the learning curve is a snap for both employers and employees.

With Gusto, you can run payroll in minutes. You can even run it on autopilot, assuming things aren’t changing each pay cycle.

The user experience of Gusto is unparalleled too. It’s incredibly simple to use even if you’re completely inexperienced with online payroll services.

Not only does Gusto calculate your taxes, but it files everything for you. Local, state, and federal taxes are automatically paid to the right government office each time you run payroll. This benefit is 100% free, while competitors charge extra for it.

I love Gusto’s onboarding process for each employee. Whether you have a new W-2 hire or 1099 contractor, they can onboard themselves.

Your staff will have easy access to pay stubs, W-2s, and everything else they need online. Even former employees will still be able to view old payroll information.

Gusto offers unlimited payroll cycles, meaning you can issue payments whenever you want. You’re not locked into weekly or bi-weekly cycles.

Gusto helps you with compliance, time-tracking, PTO, employee benefits, and more, in addition to being a full-service online payroll company.

Pricing for Gusto is as follows:

Core — $39 per month

- $6 per month per person

- Employee self-service

- Health benefits administration

- Workers’ comp administration

- PTO policies

Complete — $39 per month

- $12 per month per person

- All Core features

- Employee offers and onboarding

- Time tracking

- Time-off requests

- Employee directory and surveys

Concierge — $149 per month

- $12 per month per person

- All Complete features

- Certified HR professionals

- HR resource center

The Core plan is perfect for small teams with basic payroll. As your team scales, you may want to upgrade to the Complete package. Gusto Concierge is designed for larger businesses as a full-service HR resource.

Workers’ comp and health benefits are free to integrate with Gusto. They don’t charge any administrative fees, so you’ll only pay for the premiums.

401k plans, 529 college savings plans, HSAs, FSAs, and commuter benefits come with additional monthly base rates, as well as extra charges for each participating employee.

Gusto has everything you need in an online payroll service. We use it here at QuickSprout, and I think it’s exceptional. The only potential drawback is the price. It used to be one of the cheapest payroll options on the market, which is no longer the case.

You can try Gusto free for one month. There is no charge for setting up an account, and you’ll only pay after you run your first payroll.

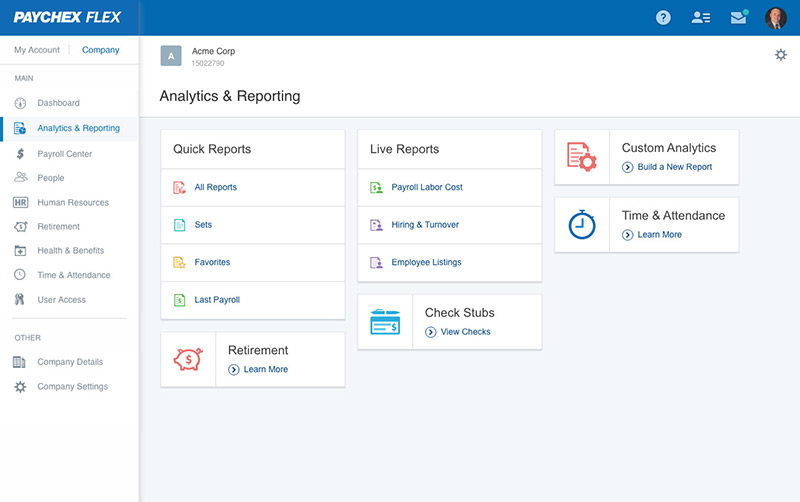

#3 – Paychex — Best for Complex Payroll Cycles

- Starts at $59 per month

- Tailored for big businesses

- 24/7 live support

- Excellent mobile app

Paychex offers some of the best solutions we’ve found for larger companies. That’s mainly due to their Paychex Flex offering.

Paychex Flex is their simplified online payroll solution that helps you process complex payroll on different schedules with just a few clicks. You’ll also get access to a host of HR features including HR administration, employee onboarding, background checks for new hires, and powerful analytics.

Depending on the plan you choose, employees can be paid via direct deposit, paper checks, or prepaid debit cards.

Paychex Go is the plan designed for small businesses. It starts at $59 per month plus $4 per employee. It’s easy to sign up and get started online by creating a free account. But, overall, the plan is pretty limited, and I’d look for other options as a small business owner.

Paychex Flex is the complete payroll and HR solution designed for larger companies. Pricing is customized based on your needs. Added benefits of Paychex Flex include:

- Free mobile app

- General ledger service

- Custom reports

- $1,000 in prepaid digital marketing services

- 24/7 phone and live chat support

- Dedicated payroll specialist

- Automatically deduct and remit garnished wages

The Flex plan also comes with employee services like extra payment options, onboarding essentials, HR administration, employee screening, and a financial wellness program.

I’d say the biggest downside of Paychex is that the sign up process isn’t as simple compared to some of the other options on our list. You’ll need to request a quote, so it’s not something that you can do on your own without any assistance.

#4 – ADP Payroll — Best for Businesses Making a Hiring Push

- Marketplace offers tons of benefits

- Pricing plans great for scaling

- Robust HR features

- 25,000+ job boards

ADP Payroll is a great all-in-one HR solution for everything from hiring, to time tracking, to background checks, to (of course) payment processing.

That’s why they’re one of the most popular solutions out there.

Where they really shine for us is in their app integrations. ADP partners with tons of benefit providers to give both employees and HR departments with perks like product discounts through LifeMart and integration with outsourced HR and a time clock software.

As such, you’re going to have a lot of ammo when coming to the table to offer the best benefits to prospective employees.

Their plans are made for scaling, which makes them great for growing businesses. They offer two “tiers” for businesses:

- Small business payroll. This is their service for smaller businesses with 1-49 employees. Great for start ups.

- Midsized to enterprise payroll. This is their service for bigger businesses with 50-1,000+ employees.

Across both levels, there are four different pricing plans your business can choose from. Expect everything from direct deposit and tax filings, to more unique benefits like legal assistance and HR training toolkits.

ADP Payroll also gives you hiring solutions. You’ll be able to conduct background checks, get access to 25,000+ job boards to find the right recruit, and also set up interview scheduling and offers of employment..

You’ll also be able to track your employees’ hours worked as well as manage their vacation days and PTO requests.

As for pricing, you’ll need to go to their website and get a free quote from them. Depending on the specific needs of your company though, you can expect to pay roughly $10 – $15 per employee.

#5 – Deluxe Payroll — Best Price for Included HR Features

- Powerful HR tools

- Makes onboarding easy

- Get all the payroll features you need

- Starts at $39/month

Payroll and human resources are close bedfellows and the tasks you routinely handle in both departments tend to go hand-in-hand. Whereas some services don’t offer much in the way of HR and others may be overkill for your needs, Deluxe offers a simple solution for running payroll and basic HR management in one package.

With Deluxe Payroll, you get everything you need to reduce headaches and time spent on recurring actions. The platform offers full-service tax filings for all 50 states in the U.S., two-day direct deposit, time tracking, paid time off administration, and detailed reporting.

Deluxe’s HR prowess really shines, though, in its included hiring and onboarding tools. Through Deluxe Payroll, you get access to the company’s Text To Apply feature—a streamlined, fully compliant way for talented people to apply for openings at your organization.

You can take that and other job postings you have on the internet and track everything in the Deluxe dashboard. The software will even simplify the process of posting new openings to the most prominent social media platforms and job boards. It even makes pre-screening and interview scheduling a cinch.

Once you’ve found a great new hire, Deluxe keeps making things easier still. You get all sorts of onboarding tools, like new hire document management, easy federal and state documentation, and customizable onboarding forms. You even get SSN verification completely for free.

And that’s all just at the basic tier of Deluxe’s payroll and HR packages:

- Lite: $39/month + $7/employee; full-service payroll with HR reports and hiring and onboarding features

- Blended: $49/month + $7/employee; HR-centric solution with no payroll or tax features

- All-Access: $39/month + $12/employee; the best of both worlds—everything in Lite and Blended

While the Lite package may be a bit high for simple payroll needs, the All-Access tier is very competitively priced, especially considering the features you get within.

The Blended package isn’t going to work if you need payroll service. And, since you’re reading this article, that means it probably won’t fulfill your needs. But the All-Access Package adds a lot of useful HR bonuses to Deluxe Payroll.

For one, you get a lot of assistance with compliance. Like with ACA compliance, where Deluxe will help you not only handle W-2, W-4, and 1099 forms but also the 1094 and 1095 forms regarding provided healthcare options.

You also get key features like the ability to track employee performance, organizational charts, customizable and shareable HR documents, and assistance with employee terminations.

Plus, All-Access unlocks helpful workflow automations for routine HR tasks, user access customization, and single sign-on through Google, Slack, and others.

If you need a solid payroll service with included HR tools that won’t break the bank, reach out to Deluxe today.

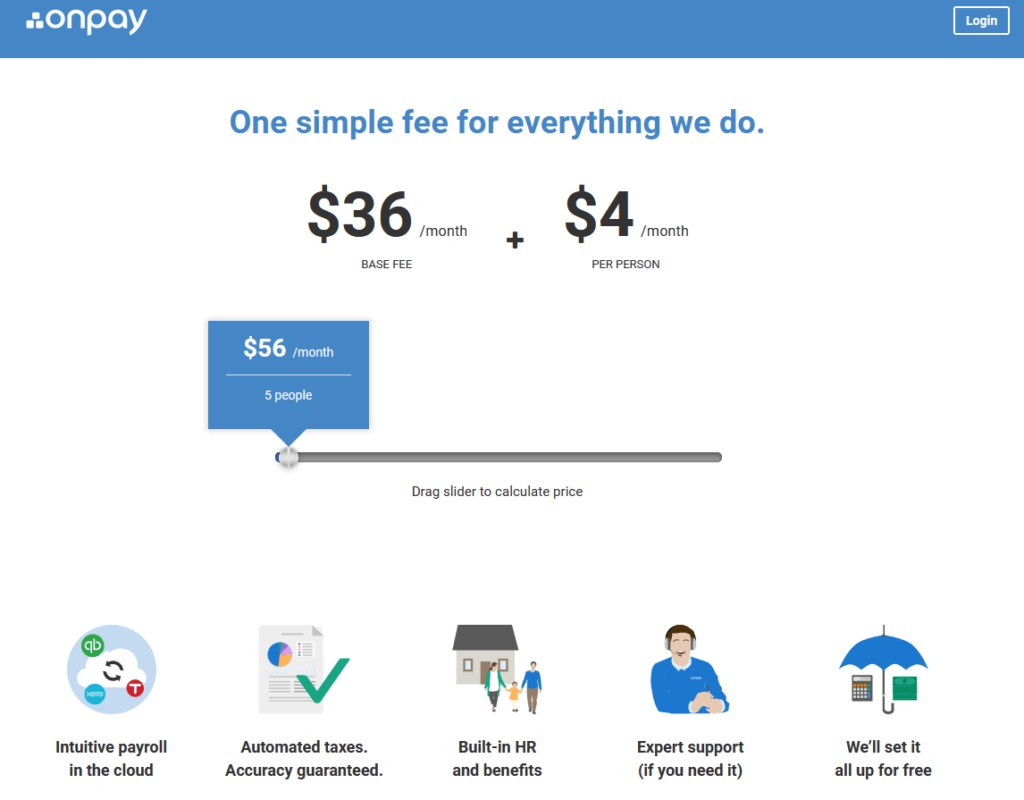

#6 – OnPay — Best for Remote Workforces

- Starting at $36 per month

- Unlimited monthly pay cycles

- Free multi-state filings

- Automated tax filings

OnPay is reliable, secure, and they’re fantastic for companies with distributed teams and employees.

That’s because they don’t charge you more for multi-state filings the way many other payroll services do. From Iowa to New York, you’ll be able to conduct payroll for your employees no matter where they are in the country.

The all-in-one payroll service has straightforward and transparent pricing. It’s $36 per month plus $4 per employee.

This is a great value compared to some of the other options on our list, especially considering all of the features and benefits that you’ll get.

- Unlimited monthly pay cycles

- Automated tax filings and payments

- Supports W-2 and 1099 workers

- 2-day turnaround

- Pay via direct deposit, live check, or debit card

- Garnishments

- Flexible pay rates and schedules

- Unemployment insurance withholding

- 40+ reports

- Time-tracking integrations

OnPay also has specialized payroll solutions for businesses in specific industries with unique needs. Examples include restaurants (e.g. taxes, wage reporting), farming, nonprofits, and churches (e.g. tax exemptions).

You’ll get everything you need to run payroll for your small business, including HR benefits that can help negotiated mixed workforces (e.g. W2 employees and independent contractors). It’s easy to add on things like employee health and dental, workers’ comp, and retirement plans.

They’ll even work with the IRS on your behalf if there are any issues with taxes.

Employees can self service their own payroll too. Your staff can onboard themselves, access their accounts even after leaving the company, and change their personal information at any time. Employees can also manage voluntary deductions like their 401k plans directly online.

Your first month using OnPay is free. They’ll also cover any migration costs from your old payroll provider.

The only major drawback of OnPay is that there they don’t have a mobile app. While the site is optimized for mobile devices, apps seem to be pretty standard in today’s day and age.

OnPay will charge you extra for any year-end forms that are mailed to your office or employees. But you could always print them out yourself to avoid those costs.

#7 – Square Payroll — Best for Retailers and Restaurants

- Starting at $29 per month

- Easy integration with Square POS

- Ecommerce friendly

- Self-service onboarding

Square is best known for its POS software and credit card processing services. But they also offer Square Payroll which is an excellent all-in-one payroll solution.

It’s no surprise then that they’re a great choice if you already use Square POS. You can easily sync those timecards with your payroll system.

Since Square also offers an ecommerce solution, this makes them a perfect payroll service for any organization that relies heavily on their ecommerce or online store.

Really though, I’d highly recommend Square if you are in either the restaurant or retail industry with physical locations. They have the equipment and integrations you need to connect your entire business online, from front to back.

They also offer one of the best ways to digitally track employee hours without having to manually enter information for each pay cycle. Square will also help you calculate and split any employee credit card tips. That’s great for restaurants.

Another top benefit of Square Payroll is the setup. You can get up and running in just a few quick steps, all done online. Simply input your company info, add your workers’ information, and run your payroll.

Alternatively, you can invite your employees to enter their own information for self-service onboarding. Square Payroll has a great mobile app for managing payroll from anywhere.

Pricing for Square Payroll is affordable and straightforward. It costs $29 per month plus $5 per person paid.

Furthermore, Square Payroll offers a unique option for businesses paying contractors. It’s just $5 per contractor per month, with no base subscription fee. This is one of the most affordable pricing plans you’ll find.

Overall, Square Payroll is perfect for businesses already using the Square POS system. It’s got everything you need to process payroll.

With all of that said, I wouldn’t recommend it to larger businesses in need of more HR resources. Square Payroll is pretty limited in that sense.

But if you have a brick-and-mortar, work in the retail or food service industries, or are a local business, you ought to try Square Payroll for your needs today.

How to Find the Best Online Payroll Services

Getting payroll on autopilot feels great, and that’s what the experience is like if you can find the right solution. No more stress for you or your employees–the checks just go out on time like magic.

There are a lot of factors to take into consideration when you’re evaluating your options. Below, you’ll find the methodology that we used during our research to create this guide.

Management & Employee Self-Service

Let’s be honest—trying to manage employee finances through an unnecessary middleman is a pain.

Enter self-service payroll.

If you choose an online payroll service that is employee-friendly, it’s going to make your employees’ lives and yours much easier too. The best payroll software allows workers to edit their personal information, manage their benefits and taxes, as well as view old pay stubs.

Some services, like Gusto, can also help employees request PTO and see exactly how many hours they have accrued for time off.

On the other side of the coin, it also allows managers to easily take a look at, make adjustments to, and analyze employees finances and working hours. This will give you the ability to stay keyed in with your employee’s payroll and your business’s overall finances.

That’s especially important when it comes to businesses that depend on hourly employees like restaurants and retail.

Some services like Gusto and Square offer a handy mobile app for stakeholders to access their payroll information. At minimum, though, you’ll want to look for an easily accessible web portal they can access on any browser.

You can even find payroll services that offer self-onboarding for employees. Just invite them to join so they can enter personal details and bank information. Your W-2 and 1099 workers can use the self-service features to access tax documents each year, instead of you having to print and mail them on your own.

Multi-State Tax Filings

This is a pretty specific element, but one that can be incredibly important to many businesses, especially with the continuing rise of distributed teams and remote work.

After all, the global pandemic has upended the way we do work and business—perhaps permanently. Fortune 500 conglomerates and small startups alike are doing more work from home. As such, many companies are seeing an increase of workers who don’t all live in one state or region.

You need a payroll service that can help manage your employees’ payroll no matter where they are.

If your employees or contractors live in other states besides the one your company is based in, you’re going to need to register with your employee’s state tax agency and adhere to that state’s tax laws.

Some online payroll services are better for these than others. In fact, some of them might charge you an extra fee to file in multiple states.

However, OnPay gives you multi-state payroll services at no extra cost to you with all of their plans. If you have a large distributed team, I cannot recommend OnPay enough.

On the other hand, Gusto requires you to pay a little extra each month for multi-state payroll. You can’t just coast by on their cheapest plan like OnPay.

Specialized Payroll Solutions

Payroll can be as complex or as simple as the industry it serves.

For example, industries such as farms, nonprofits, food service, and contractor-reliant operations are going to require a more complex payroll system. Whereas a bootstrap startup with just three employees is going to be fairly simple.

OnPay is a good solution for most small businesses. But they also offer complex solutions for dentists, restaurant owners, or even tax-exempt organizations like nonprofits and churches.

For example, they help churches and other religious orgs exclude federal unemployment tax, Social Security tax, Medicare tax, and allowances for parsonage from their filings. They also ensure accurate filings for federal unemployment tax for nonprofits.

Square Payroll is excellent for retail businesses and restaurants since one of their most popular offerings is a handy point-of-sale solution often used by those types of businesses.

In fact, their restaurant payroll service includes specific tools for front-of-house and back-of-house employee management. That’s very handy, especially when we consider that taxes differ wildly for restaurant workers from state to state.

Pay Cycle Frequency

How often do you want to run payroll?

A lot of online payroll systems won’t restrict you to just once per week or twice per month. There are plenty of options out there that offer unlimited payroll each month like OnPay and Gusto.

This is great for those of you who don’t want to be tied into a specific schedule. In some instances, you can even let your employees decide when and how they get paid.

Maybe you want employees on salary to get paid automatically each week. But you want to manually pay independent contractors for specific amounts only once per month. There are online payroll services that let you do both with ease.

This is especially helpful for companies that leverage both W9 and 1099 employees (as many orgs are want to do nowadays). This flexibility will be a boon to your company’s overall health and finances.

All-in-One Benefits

Not every payroll system has built-in options for you to set up and manage employee benefits. I’m referring to things like:

- Workers’ compensation

- 401k plans

- HSAs

- Health insurance

- Vision and dental

So if you’re offering these types of benefits to your employees, you need to find a payroll system that’s accommodating.

It’s a lot easier to manage benefits and payroll if they’re centralized on one system and portal. You don’t want to have to send your employees to a bunch of different websites to access each of their payment and benefits information. It’s annoying, and can result in a lot of confusion down the line.

Gusto and ADP Payroll are standouts in this regard. They offer an easy solution for your HR and payroll needs. ADP even partners with a ton of different benefits solutions, so you can treat your employees to things like discounts to gyms, wellness rewards, and even financial savings programs.

That can go a long way to helping both retain your talent and recruit.

Square Payroll, on the other hand, offers fairly limited employee benefits solutions (just health insurance, workers’ comp, and 401k).

Conclusion

Every business needs a payroll solution. But not every online payroll service is created equally. There are definitely options on the market that are better than others.

What’s the best online payroll service? The answer is different for each business owner. Here’s a quick recap of the best choices based on our methodology:

- QuickBooks Payroll — The best for a worry-free tax season

- Gusto — The best if you have a ping-pong table in the break room

- Paychex — The best for complex payroll cycles

- ADP Payroll — The best for businesses making a hiring push

- Deluxe Payroll — The best price for included HR features

- OnPay — The best for remote workforces

- Square Payroll — The best for retailers and restaurants

Whether you have a small business, large corporation, or have unique payroll needs, there is definitely a solution for you in this guide.

from Quick Sprout https://ift.tt/2sOeAm8

via IFTTT

No comments:

Post a Comment